Investments

Our short-term focus is the long-term.

Coastline Trust Company focuses on your unique goals and objectives when it comes to your investments.

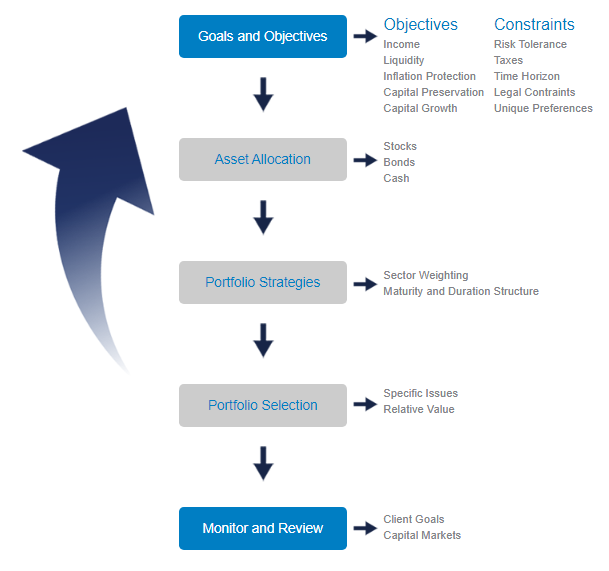

The Coastline Trust Investment Process

First, it is important that you identify your objectives when it comes to income generation, liquidity, inflation protection, capital preservation, and capital growth. Are you trying to grow your net worth to beat inflation or emphasize current income to meet current expenditures?

Your objectives are subject to a number of constraints including your risk tolerance, your tax situation, your time horizon, etc. The more risk you are willing to take, the more growth potential you can seek. If your time horizon, is very long, you may be able to afford to take more risk and have more in stocks and less in cash and bonds. Your objectives and constraints drive your overall asset allocation. Simply put, how much to allocate to cash, bonds, and stocks.

Next, you will want to consider such things as bond durations and stock sector weightings. Do you want to index or have tactical over or underweights with respect to the various benchmarks?

Only after these higher level decisions are made do you want to focus on which stock, bond, fund to purchase. Periodically, your asset mix and portfolio need to be reviewed and rebalanced based on your then current goals and the outlook for the various capital markets.